TL;DR

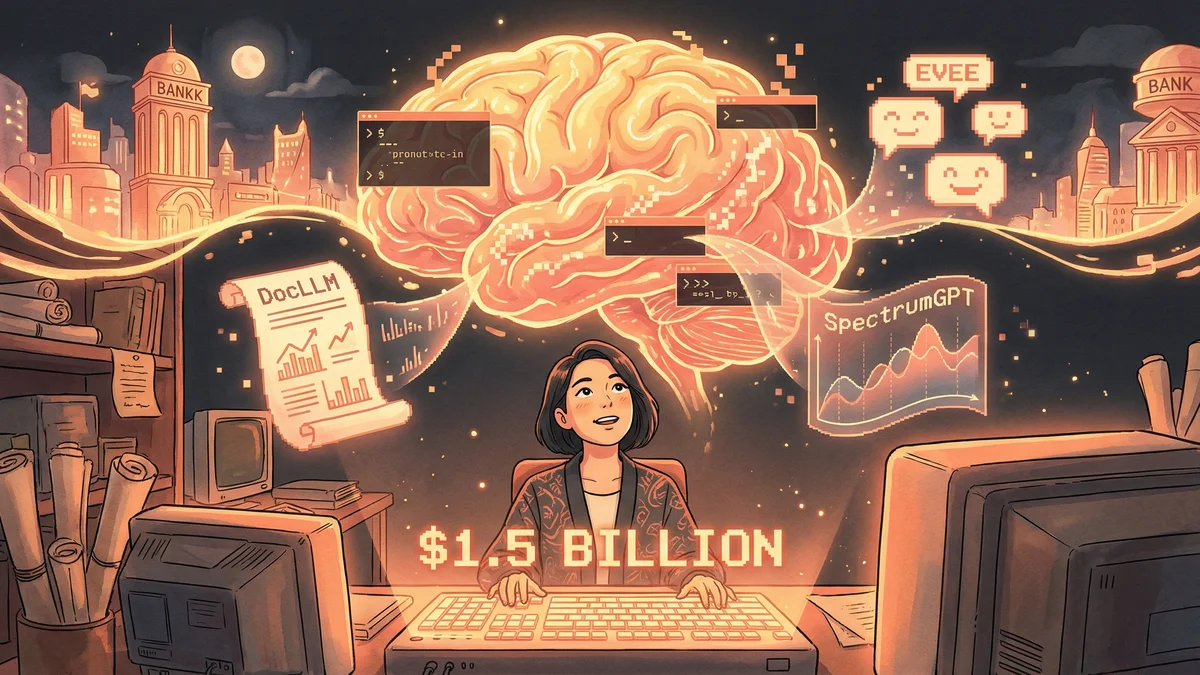

- JP Morgan deployed AI to 200,000 employees, the largest known enterprise AI deployment

- Measured value: $1-1.5 billion in first year; 40% reduction in risk alert false positives

- Built model-agnostic architecture to swap AI providers without rebuilding systems

- Best for: Enterprise leaders planning large-scale AI deployments

- Key principle: AI recommends, humans decide — augmentation, not replacement

JP Morgan built the largest internal AI deployment in financial history, giving 200,000 employees access to specialized AI tools that generated over $1 billion in measured value within the first year.

JP Morgan Chase processes more money than most countries.

As America’s largest bank, they handle trillions in daily transactions. Their competitive advantage depends on making decisions faster and smarter than anyone else.

“We’re not a bank that uses technology. We’re a technology company that happens to be in banking.”

The bank’s CEO Jamie Dimon wasn’t exaggerating. JP Morgan spends $17 billion annually on technology. But in 2024, they made a bet that would transform how 200,000 employees work.

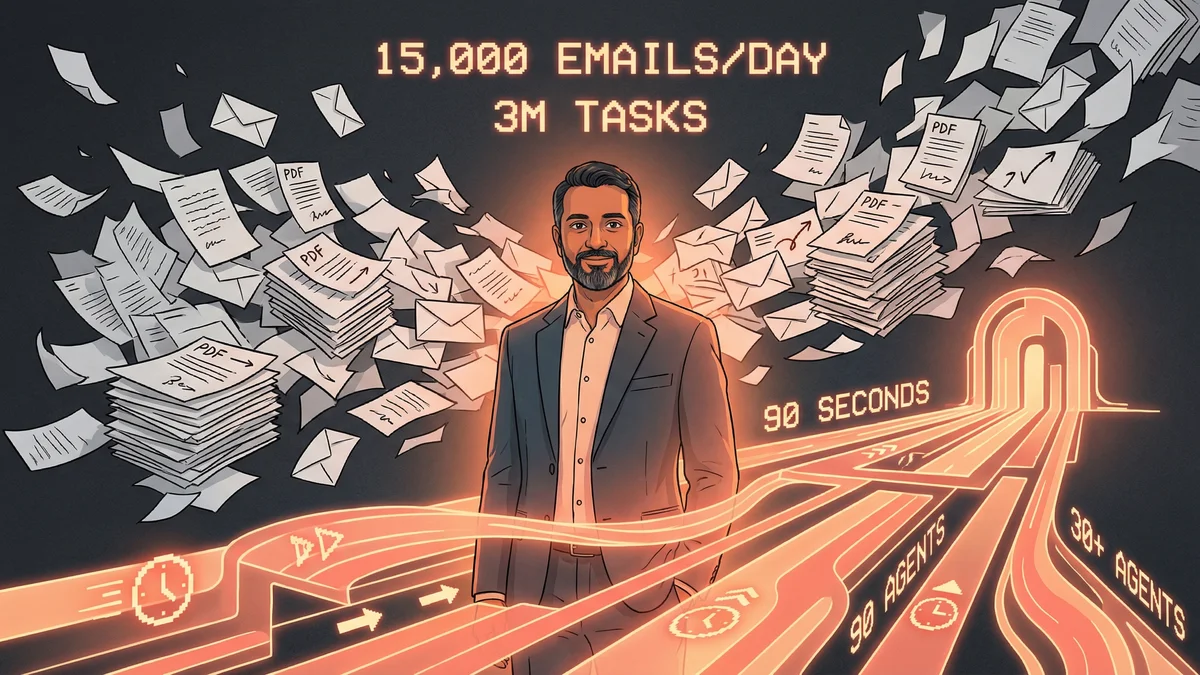

The scale of the problem

Financial services generates paperwork like no other industry.

Loan applications. Risk assessments. Regulatory filings. Market analyses. Customer communications. Each document requires human review. Each review takes time. Each delay costs money.

“We had thousands of analysts spending hours reading documents that AI could scan in seconds. The question wasn’t whether to deploy AI. It was how to do it at scale.”

The bank needed AI that could understand financial documents, analyze market signals, handle customer questions, and do it all without compromising the security that banking demands.

The LLM Suite

JP Morgan didn’t buy off-the-shelf AI. They built their own.

The LLM Suite became the largest known internal AI deployment in any enterprise. Two hundred thousand employees—from traders to customer service to back-office operations—got access.

The system isn’t one AI. It’s an ecosystem:

DocLLM handles multimodal document understanding. Loan applications with handwritten notes, PDFs with embedded tables, scanned contracts with faded ink. The AI processes documents that would stump simpler systems.

SpectrumGPT analyzes trading signals. Market patterns that human traders might miss appear in its analysis. Not to replace traders, but to give them an edge.

EVEE supports call centers. Customer questions that used to require supervisor escalation get resolved in seconds.

The results

The numbers tell the story.

Value at Risk (VaR) limit breach anomalies—cases where trading positions triggered risk alerts—dropped by 40%. Fewer false alarms means traders focus on real issues.

The estimated AI-generated value: $1 billion to $1.5 billion.

Not projected. Measured.

“The ROI exceeded our projections in year one. And we’re just getting started.”

The architecture that made it work

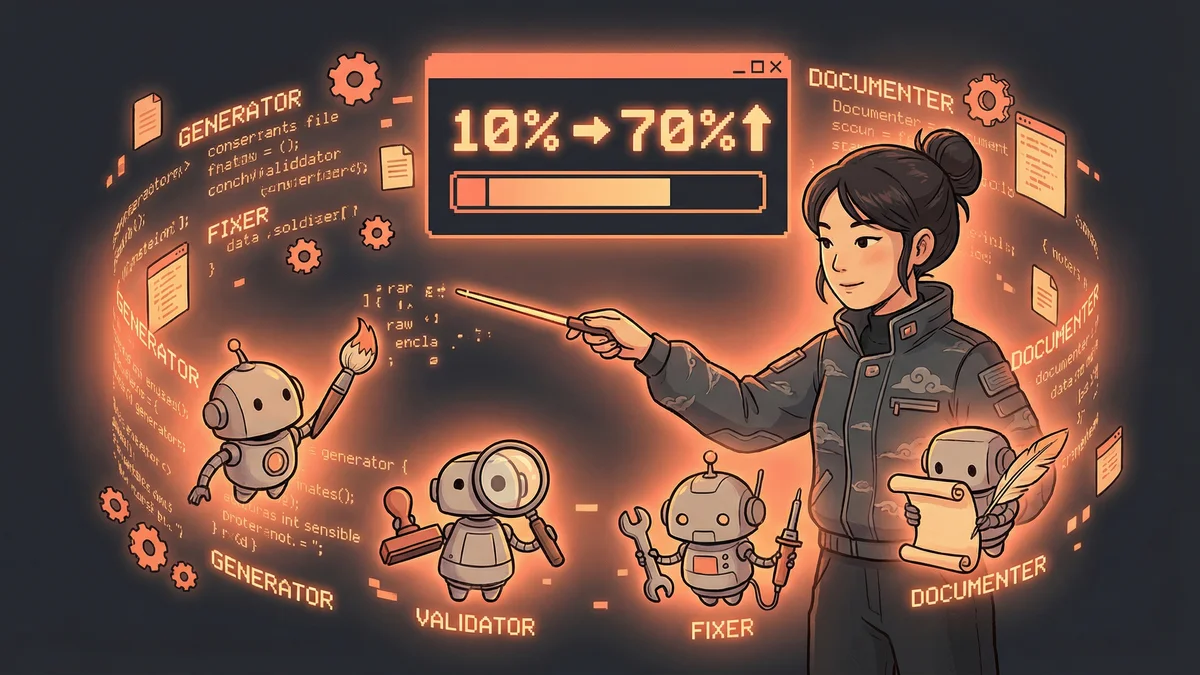

JP Morgan’s approach wasn’t “deploy AI everywhere and hope.” It was surgical.

They built model-agnostic architecture. When a better AI model emerges—from OpenAI, Anthropic, or their own research labs—they can swap it in without rebuilding systems.

They invested $7 billion in technology to support the deployment. Not just for AI, but for the security, compliance, and infrastructure AI requires.

They maintained human oversight everywhere it matters. AI recommends. Humans decide. That boundary never blurred.

“AI that makes autonomous decisions in banking is a lawsuit waiting to happen. AI that makes humans faster and smarter is a competitive advantage.”

What this means

JP Morgan proved something the enterprise world needed to see.

AI deployment at massive scale—200,000 users, trillion-dollar transactions—isn’t theoretical. It’s operational.

The bank’s approach offers a template:

Build, don’t just buy. Generic AI tools don’t understand banking. Custom systems trained on financial data do.

Architect for change. The AI landscape evolves monthly. Lock into one vendor and you’re obsolete by next quarter.

Measure everything. The $1.5 billion value isn’t a guess. It’s calculated from specific improvements in specific workflows.

Keep humans in charge. The AI makes recommendations. Humans make decisions. That’s not a limitation—it’s a feature.

“We’re not replacing bankers with AI. We’re giving bankers superpowers.”

The trillion-dollar brain isn’t autonomous. It’s augmented.

And it’s just beginning.