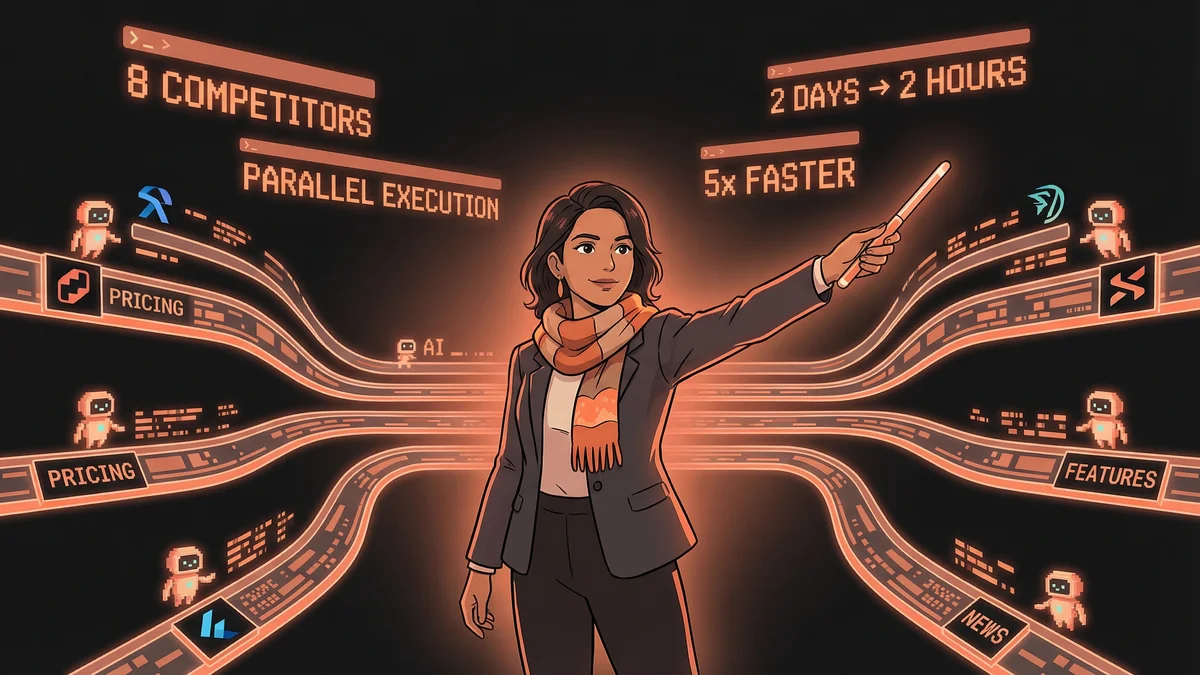

TL;DR

- 8 competitor analyses completed in 2 hours instead of 2 days (5x improvement)

- Claude Code researches companies in parallel: pricing, features, positioning, news

- Output: individual analysis files plus synthesized competitive matrix

- Best for: competitor research, vendor evaluation, market sizing, conference prep

- Sweet spot: 8-10 parallel tasks; more causes quality issues

Parallel AI research can analyze 8 competitors simultaneously, delivering complete pricing tables, feature lists, and positioning summaries in hours instead of days.

Teresa stared at her list of competitors. Eight companies. Each needing thorough research. Pricing pages. Feature lists. Positioning statements. Recent news.

The traditional approach: research one, write notes, move to the next. Eight rounds of focused work. A full day, maybe two.

“That’s how research always worked. Sequential. Thorough. Slow.”

Then she discovered parallel execution. And research would never be the same.

The Sequential Problem

Competitor research was Teresa’s regular task. Product decisions needed market context.

The pattern was always the same:

- Pick a competitor

- Visit their website

- Read their pricing page

- Document the features

- Note their positioning

- Check recent news

- Write up findings

- Repeat for the next competitor

“Each company took 45 minutes to an hour. Eight competitors meant six to eight hours. Spread across two days because research fatigue is real.”

The time added up. The opportunity cost was significant. Other work waited.

The Parallel Discovery

Teresa learned Claude Code could spawn multiple research threads.

Not one task at a time. Many tasks simultaneously.

“I asked: ‘Research these eight competitors in parallel. For each one, visit their website, document their pricing, list their main features, and summarize their positioning.’”

Claude started eight research streams. Each competitor investigated independently.

The Execution

Teresa watched the parallel execution unfold.

Claude reported progress: “Researching Company A: reading pricing page…” “Researching Company D: extracting feature list…” “Researching Company F: summarizing positioning…”

Multiple streams of work happening at once. The computer doing what she physically couldn’t — being in eight places simultaneously.

“I made coffee. Checked email. The research was happening without me.”

The Time Collapse

Two hours later, Claude had finished.

Eight complete research summaries. Pricing tables. Feature lists. Positioning analyses. All delivered as separate files in her research folder.

“What would have taken me two days took two hours. Same thoroughness. Same detail. A 5x speed improvement.”

The math was simple but powerful. Parallel execution multiplied capacity.

The Quality Check

Speed meant nothing if quality suffered.

Teresa reviewed each file. The information was accurate. The sources were cited. The analysis was thoughtful.

“Claude found details I might have missed. Buried pricing tiers. Feature announcements from blog posts. Positioning changes I didn’t know about.”

The parallel approach wasn’t just faster — the AI’s thoroughness exceeded her fatigued human attention by hour six.

The Synthesis Layer

Eight research files were valuable. Combined insights were more valuable.

Teresa added a synthesis step: “Based on all eight company analyses, create a competitive matrix comparing pricing, features, and positioning. Identify gaps in the market.”

Claude read its own outputs, cross-referenced, synthesized.

“The matrix showed patterns I couldn’t see by reading files sequentially. Pricing clusters. Feature gaps. Positioning whitespace.”

The Research Template

Teresa codified the parallel approach into a template.

Her prompt became a formula:

Research the following [N] companies in parallel:

[Company list]

For each company, document:

1. Pricing (all tiers, key features per tier)

2. Main features (categorized by type)

3. Target market (who they're built for)

4. Positioning (how they describe themselves)

5. Recent news (last 3 months)

Save each analysis as a separate file: [company-name]-analysis.md

After all research is complete, create competitive-matrix.md summarizing all findings.The template made parallel research repeatable. New competitor set, same process.

The Application Expansion

Parallel research wasn’t just for competitors.

Teresa used the same pattern for:

- Vendor evaluation: Research five software vendors simultaneously

- Conference preparation: Investigate all speakers in parallel

- Market sizing: Research multiple market segments at once

- Customer discovery: Research multiple customer profiles simultaneously

“Any time I had a list of things to research, I could parallelize. The pattern was universal.”

The Constraint Calibration

More parallel streams weren’t always better.

Teresa learned the limits. Too many parallel tasks and quality dropped. Context got confused. Results got sloppy.

“Eight competitors was fine. Twenty started causing issues. I learned to batch: first eight, review, then next eight.”

The sweet spot depended on task complexity. Simple lookups could handle more parallel streams than deep analysis.

The Resource Reality

Parallel execution used more resources.

“My computer worked harder. Claude used more tokens. The cost per minute was higher.”

But the total cost was similar — the same work, compressed in time.

“I wasn’t paying more for parallel. I was paying the same amount faster. Time savings were free.”

The Workflow Integration

Teresa integrated parallel research into her planning.

Monday morning: Define research needs for the week Monday afternoon: Launch parallel research batches Tuesday morning: Review and synthesize Rest of week: Use insights for actual work

“Research stopped being the time-consuming bottleneck. It became the quick preparation before real work began.”

The Competitive Edge

Teresa’s clients noticed the difference.

“Deliverables came faster. Analyses were more comprehensive. I could cover market landscapes that would have taken weeks in days.”

The parallel capability wasn’t just personal efficiency — it was competitive advantage.

“Other consultants were still doing sequential research. I was doing parallel. Same deliverable quality, fraction of the time.”

The Caution Note

Teresa acknowledged limitations.

“Parallel doesn’t mean automated. I still reviewed everything. Claude sometimes misunderstood a company’s positioning or missed a pricing detail.”

The human review remained essential. Parallel accelerated research, not judgment.

“Think of it as parallel data gathering with sequential evaluation. The gathering scales. The evaluation doesn’t.”

The Recommendation

For anyone drowning in research tasks:

“List what you need to research. Ask Claude to do it in parallel. Go do something else. Return to completed summaries.”

The sequential habit was hard to break. But once broken, there was no going back.

“Research used to be the thing I dreaded. Now it’s the thing that happens while I’m having coffee. That shift changes how much you can accomplish.”