TL;DR

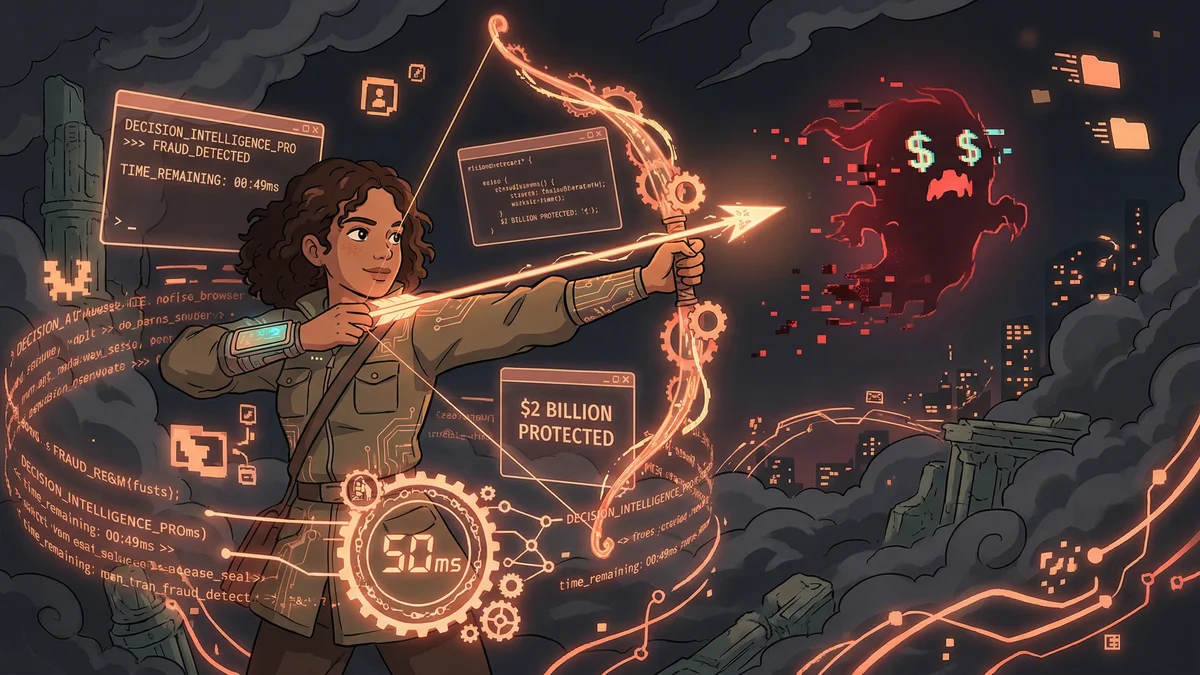

- Mastercard’s AI prevents $2+ billion in fraud annually with 20% better detection rates

- Decisions made in under 50 milliseconds on 4,500 transactions per second

- AI cut false positives by 85% — fewer declined legitimate purchases

- Best for: high-volume financial systems requiring real-time decisions

- Key insight: personalized behavioral analysis beats rule-based detection every time

Mastercard’s AI fraud detection prevents over $2 billion in fraud annually while reducing false positives by 85%, making real-time decisions in under 50 milliseconds across 143 billion yearly transactions.

Mastercard processes 143 billion transactions per year.

That’s 4,500 transactions every second. Each one needs a decision: legitimate or fraud. The decision must happen in under 50 milliseconds — before the card reader times out.

“You’ve got the time it takes to blink. In that moment, we have to know whether someone in Tokyo buying electronics is the actual cardholder or a thief in Estonia using stolen numbers.”

Getting it wrong has consequences. Let fraud through, and real money vanishes. Block legitimate transactions, and customers switch to competitors.

For decades, rule-based systems made these calls. They worked adequately. Then AI changed what “adequate” meant.

The Old Rules

Traditional fraud detection ran on explicit rules.

If transaction amount exceeds $500 and merchant category is electronics and cardholder location is more than 100 miles from home, flag for review.

These rules caught obvious fraud. They also generated false positives — legitimate purchases that looked suspicious but weren’t.

“A business traveler buying a laptop in a foreign city hit multiple rules simultaneously. Their card got declined at the register. They weren’t happy.”

False positives damage customer relationships. Card declines embarrass people. Some never use that card again.

“Every declined legitimate transaction has a cost. Lost sale. Lost customer loyalty. Lost future revenue.”

The rule-based systems couldn’t learn. They got manually updated when fraud patterns changed. By definition, they were always behind.

The AI Revolution

Mastercard’s Decision Intelligence Pro represents a different approach entirely.

Instead of explicit rules, the system learns patterns from billions of historical transactions. It understands what “normal” looks like for each cardholder and recognizes when something deviates.

“The AI doesn’t just ask ‘is this transaction suspicious?’ It asks ‘is this transaction suspicious for THIS cardholder at THIS merchant at THIS time?’”

The personalization matters. A $3,000 transaction from someone who regularly makes large purchases is normal. The same transaction from someone who usually buys coffee is unusual.

The Speed Requirement

Fifty milliseconds. That’s the constraint.

Card networks have strict latency requirements. If the fraud decision takes too long, the transaction times out. The merchant either accepts without verification (risky) or declines (frustrating).

“Our models have to be fast AND accurate. Fast but wrong is useless. Accurate but slow is useless.”

The AI runs on specialized infrastructure optimized for inference speed. Models are compressed and optimized to deliver decisions in single-digit milliseconds.

“We have time budgeted for network latency, processing, response formatting. The actual fraud decision gets maybe 5-10 milliseconds.”

The Results

The numbers after deployment justified years of development.

$2+ billion in fraud prevented in the first 12 months.

20% average improvement in detection rates across the network.

Up to 300% improvement in specific high-risk sectors.

85% reduction in false positives — legitimate transactions incorrectly flagged.

“That last number might be the most important. We caught more fraud while declining fewer good customers. Both metrics improved simultaneously.”

The Detection Logic

The AI evaluates transactions across multiple dimensions:

Cardholder behavior: Purchase patterns, typical amounts, merchant categories, geographic zones, time-of-day preferences.

Merchant characteristics: Is this merchant associated with fraud? What’s the typical transaction profile here?

Device signals: What device is making the transaction? Have we seen it before? Does it match the cardholder’s known devices?

Network patterns: Are other cards showing similar suspicious patterns? Is there a broader attack happening?

Contextual factors: Is this holiday shopping season? A known event period? A day when legitimate spending spikes?

“No single signal is decisive. The model weighs everything together. Sometimes a transaction that looks suspicious on three dimensions is clearly legitimate when you consider two others.”

The False Positive War

False positives — declining legitimate transactions — drove much of the AI investment.

“Every false positive is a customer service disaster. The cardholder is embarrassed. They call the bank. The bank calls us. Everyone’s upset.”

Rule-based systems generated millions of false positives annually. Each one required investigation, customer communication, and relationship repair.

“We calculated the lifetime value loss from false positives. A declined transaction doesn’t just lose that sale. It changes customer behavior permanently.”

The 85% reduction in false positives translates to millions of preserved customer relationships.

The Explainability Challenge

When AI declines a transaction, someone needs to explain why.

Regulators require explanations. Customers demand them. Customer service needs them to resolve disputes.

“A black box that says ‘declined because the algorithm said so’ doesn’t work. We need to say ‘declined because this transaction was 200 miles from your usual location, at an unusual time, for an unusual amount, at a merchant category you’ve never used.’”

Mastercard’s system generates explanations alongside decisions. The AI doesn’t just say “fraud” — it says why.

“Explainability is a feature, not an afterthought. The best fraud detection is useless if you can’t justify the decisions.”

The Human Layer

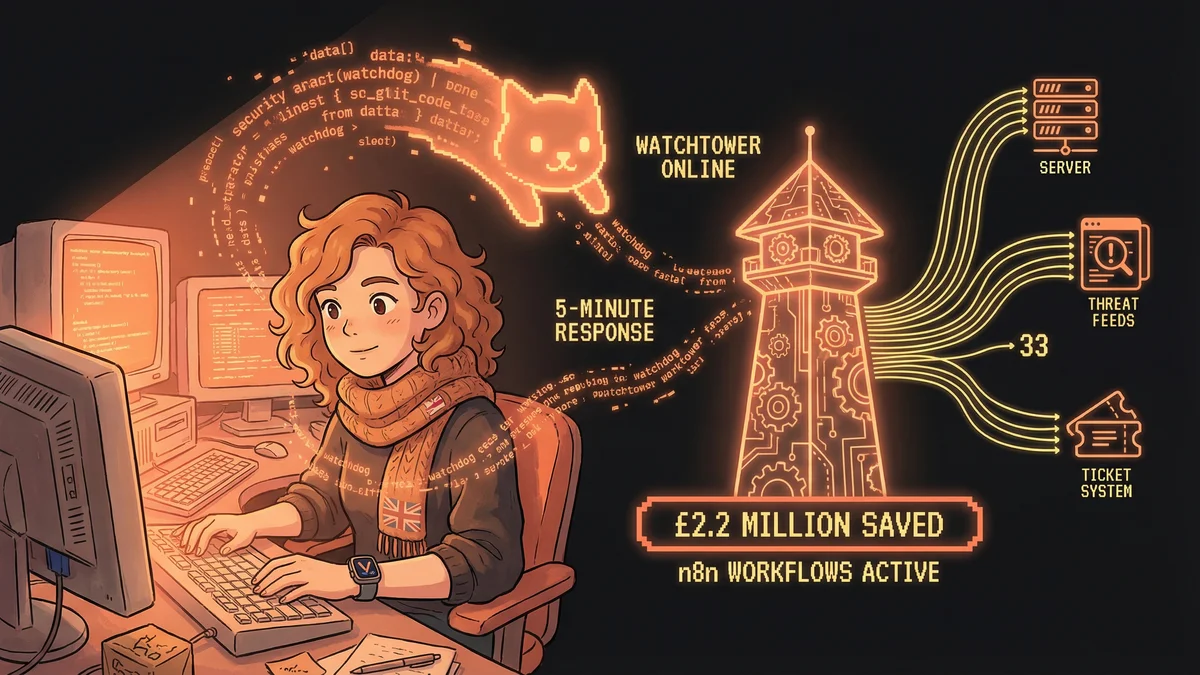

AI doesn’t work alone.

Fraud analysts investigate edge cases. When the AI is uncertain — confidence between the clear-fraud and clear-legitimate thresholds — humans review.

“The AI handles the obvious cases at both ends. Humans handle the middle. That’s the right division of labor.”

Human feedback improves the models. When analysts override AI decisions, those cases become training examples. The system learns from disagreements.

The Arms Race

Fraud detection is adversarial. Criminals adapt.

“Every time we get better at catching fraud, the fraudsters get better at evading detection. It’s an endless game.”

AI helps in this arms race. When new fraud patterns emerge, the model can detect anomalies even before analysts understand them.

“We’ve caught fraud schemes that nobody had seen before. The AI noticed patterns that weren’t in any playbook. It saw that something was wrong before it knew exactly what.”

The Network Effect

Mastercard’s advantage is data volume.

“We see 143 billion transactions per year. That’s training data no single bank or merchant could generate.”

Fraud patterns detected in one region inform protection in others. A new attack vector in Europe might already be blocked in Asia because the network learned from it.

“Our models get smarter from every transaction, everywhere. That’s an unfair advantage we’re happy to have.”

The Merchant Partnership

The AI benefits merchants directly.

Fraud chargebacks hurt merchants. When stolen cards make purchases, merchants often absorb the loss. Better detection means fewer chargebacks.

“Merchants used to see us as a cost center. Now they see us as a protection layer. Good fraud detection is a feature they pay for.”

Some merchants receive customized models. Their specific fraud patterns get incorporated. The protection fits their business.

The Consumer Experience

The end goal isn’t catching fraud — it’s enabling trust.

“People swipe their cards without thinking. They expect it to work. That expectation depends on fraud detection being invisible and effective.”

When the system works perfectly, no one notices. Legitimate transactions flow. Fraud gets stopped. The machinery operates in the background.

“Our best day is when nothing happens. When fraud stays near zero and customers transact without friction.”

The Ongoing Investment

Decision Intelligence Pro represents years of continuous development.

“This isn’t a project you finish. It’s a capability you build forever. Every day the models improve. Every quarter we add features. Every year we handle more transactions.”

The 50-millisecond constraint forces constant optimization. Better models need to run faster. More signals need to be evaluated in less time.

“We’re not satisfied with current performance. We want to catch more fraud, decline fewer good transactions, and do it faster. Always.”

The Pattern for Others

Mastercard’s approach offers lessons for any high-volume decision system.

Speed is a feature. Latency constraints force architectural discipline.

Personalization beats rules. Individual context matters more than general patterns.

False positives matter. The cost of wrong decisions goes beyond the immediate case.

Explainability is required. Decisions need justification for humans, regulators, and customers.

The game never ends. Adversarial systems require continuous improvement.

“We’re not building a fraud system. We’re building trust infrastructure. That’s a permanent job.”