TL;DR

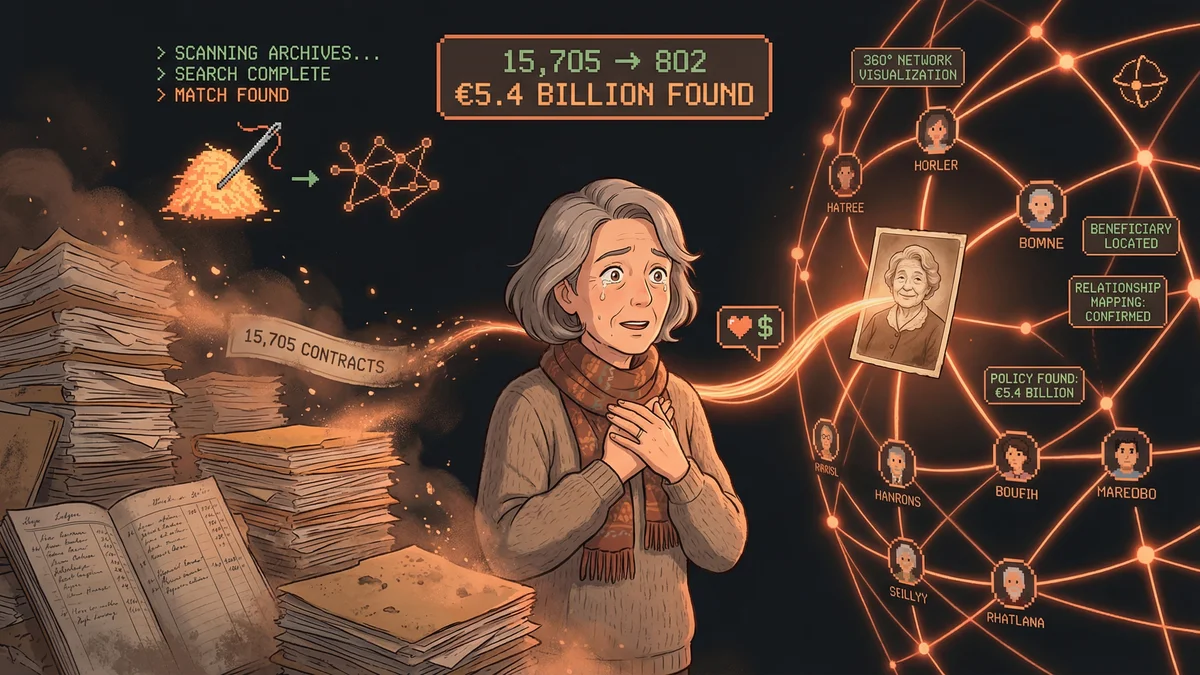

- Generali France reduced unclaimed life insurance contracts from 15,705 to 802 (95% reduction)

- AI enables 360° visualization of client networks to locate beneficiaries

- Death identification within one year improved from 33% to 88%

- Best for: Insurance, banking, any industry with dormant assets and lost customers

- Key insight: AI can solve “needle in haystack” compliance problems that are manually impossible

Generali France used AI to slash unclaimed life insurance contracts from 15,705 to just 802—finding beneficiaries who didn’t know they were owed money and returning €5.4 billion in dormant assets to rightful owners across France.

Someone’s grandmother died.

She had a life insurance policy. The beneficiary—maybe a grandchild, maybe a niece, maybe someone who moved fifteen years ago—has no idea the money exists.

The insurer knows. But they can’t find the beneficiary. The person’s address is outdated. Their name may have changed. They don’t respond to letters because they never received them.

The money sits. Year after year. In France alone, unclaimed life insurance benefits reached €5.4 billion by 2015.

This wasn’t just an operational problem. It was a moral one. People were owed money that would never reach them.

Generali France decided to solve it with AI.

The Regulatory Pressure

In 2016, France enacted the Eckert Act.

The law imposed obligations insurers had avoided: actively search for beneficiaries. Don’t just wait for them to claim. Find them.

Specific requirements:

- Insurers must identify when policyholders die

- Beneficiaries must be located and contacted

- Benefits unclaimed for more than 10 years must be deposited with the government

The industry faced a choice: build massive manual search operations or find a smarter way.

The Scale Problem

Twenty percent of life insurance beneficiaries don’t appear after a policyholder’s death.

Some don’t know they’re named. Some can’t be reached at recorded addresses. Some have died themselves. The information is fragmented, outdated, incomplete.

“How do you find someone who doesn’t know they’re owed money, doesn’t know to contact you, and may have moved multiple times since the policy was written?”

Manual searches work for some cases. But at scale—thousands of contracts, millions of potential matches—human effort alone couldn’t solve it.

Generali France had 15,705 contracts classified as unclaimed in 2016. Finding each beneficiary manually would require investigative work: searching public records, cross-referencing databases, tracing family networks.

Multiplied by fifteen thousand. Every year, as new policies matured and new beneficiaries went missing.

How IBM Watson Finds Missing Beneficiaries

Generali deployed IBM Watson to investigate beneficiaries of unclaimed contracts.

The system creates a 360-degree visualization of clients and their networks:

Family mapping. Policy documents name beneficiaries, but relationships change. Children get married. Names change. People move. The AI maps the network of relationships that might connect a policyholder to their beneficiaries.

Address history. Where has this person lived? Where have their relatives lived? Cross-reference public records, postal databases, and other sources to find current addresses.

Death registry integration. The AI monitors death registries automatically. When a policyholder dies, the system knows—often before anyone files a claim.

Network analysis. Sometimes the beneficiary can’t be found directly. But their sibling can. Or their employer. The AI identifies paths to reach people through their connections.

“AI enables a 360° visualisation of clients and their networks,” the implementation described, “to meet legal obligations regarding beneficiary searches.”

The Results

The numbers tell the transformation:

2016: 15,705 contracts classified as unclaimed

2023: 802 contracts classified as unclaimed

A 95% reduction in unclaimed policies.

The improvement in death identification was equally dramatic:

2017: 33% of deaths identified and processed within one year

2023: 88% of deaths identified and processed within one year

Beneficiaries who would never have known they were owed money received payments. Families received support after losses. Legal obligations were met.

The Broader AI Deployment

Beneficiary search was one piece of Generali France’s AI transformation.

The company now operates:

3,700 employees with access to Microsoft 365 Copilot

70% workforce adoption with 15 prompts per user per week on average

300 robots automating processes daily (2.1 million operations in 2024)

1.3 million calls resolved directly by AI agents (30% of customer requests)

50 specialized agents deployed across different use cases

4.5 million emails read and indexed by AI systems

17 business use cases in production with ~30 more planned

“Our employees no longer need to perform repetitive, low-value tasks,” said Emmanuel Néré, Director of Innovation and Transformation. “This technology brings us into a new dimension.”

The Pattern: Needle in Haystack Compliance

Generali’s success reveals a pattern for AI in regulated industries.

The problem: Compliance requirements that are theoretically simple but practically impossible at scale. “Find every beneficiary” is easy to mandate. Actually doing it for thousands of cases requires investigative work that humans can’t scale.

The solution: AI that can scan massive datasets, identify patterns and connections, and surface the specific needles in the haystack.

The result: Compliance that was previously aspirational becomes achievable. Obligations that would have required armies of investigators get handled by systems.

This pattern applies beyond insurance:

- Banking: Finding owners of dormant accounts

- Government: Locating recipients of unclaimed benefits

- Pensions: Tracing beneficiaries of retirement accounts

- Legal: Identifying heirs in estate proceedings

Any domain with lost customers, dormant assets, or hard-to-find stakeholders.

The Human Evolution

The AI didn’t replace Generali’s compliance team. It transformed their work.

Before: manually searching records, making phone calls, sending letters, tracking responses, managing case files.

After: reviewing AI findings, handling exceptions, making judgment calls, focusing on the genuinely difficult cases.

“70% of our employees believe that AI will transform their profession,” Néré noted. The transformation is happening—not through job elimination but through job evolution.

The compliance team that once struggled to investigate 15,000 cases now manages 800. Their expertise applies to the genuinely difficult searches, not routine data matching.

The Ethical Dimension

This story has a human element that efficiency metrics don’t capture.

Each unclaimed contract represents someone who lost a family member. Someone who was supposed to receive support during a difficult time. Someone who may have needed that money.

Finding those people isn’t just regulatory compliance. It’s doing right by customers—even customers who don’t know they’re customers.

“Due benefits and unclaimed for more than 10 years must be deposited with the government,” the Eckert Act mandates. But Generali’s goal wasn’t to wait ten years and hand money to the government. It was to find the people who were supposed to have it.

From 15,705 to 802. Each number represents a family found, a benefit paid, an obligation honored.

The Technology Stack

Generali’s AI deployment spans multiple platforms:

IBM Watson for beneficiary investigation—network analysis, relationship mapping, and entity resolution

Microsoft 365 Copilot for everyday productivity—email summaries, document structuring, information retrieval

Azure OpenAI for customer-facing agents—handling 1.3 million calls through AI

RPA robots for process automation—2.1 million operations annually

Copilot Studio for custom agents—50 specialized bots across use cases

The approach is platform-agnostic. Different tools for different problems. The beneficiary search uses investigative AI; the call center uses conversational AI; the back office uses robotic process automation.

The Template

Generali’s experience offers lessons for any organization facing “find the needle” compliance challenges:

Map the network, not just the individual. The beneficiary might be unreachable, but their connections might not be.

Integrate with authoritative sources. Death registries, address databases, public records—the AI needs access to the data that would help a human investigator.

Measure what matters. “Unclaimed contracts” is the metric. Track it rigorously. The 95% reduction proves the system works.

Start with the legal mandate. Regulations forced action. Without the Eckert Act, the problem might have persisted indefinitely.

Deploy humans for exceptions. The 802 remaining cases in 2023 are genuinely hard. They need human judgment, not more automation.

The €5.4 billion in unclaimed benefits didn’t disappear because insurers were villains. It accumulated because finding people is hard. AI made it possible at scale.

Fifteen thousand families found. That’s the number that matters.