TL;DR

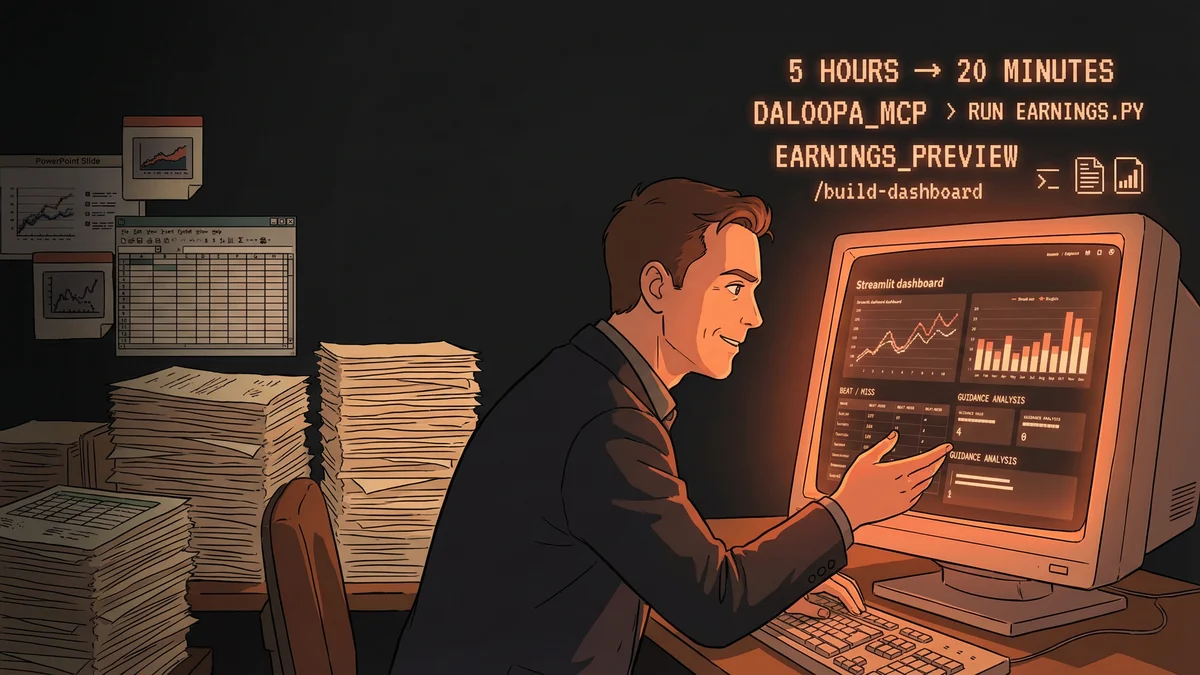

- 5 hours of earnings preview work compressed to 20 minutes with interactive output

- MCPs connect Claude Code directly to institutional-grade financial data (Daloopa, Perplexity Finance)

- Prompts live in GitHub as version-controlled skills—not throwaway ChatGPT messages

- Best for: Financial analysts, hedge fund researchers, anyone doing systematic equity research

- Key lesson: Web AI caps at 20-30 minutes of compute. Claude Code unlocks the full processing power LLMs actually offer.

A former hedge fund analyst discovered that Claude Code’s real power isn’t writing apps—it’s building custom research infrastructure that runs for as long as the analysis requires.

Five hours.

That’s how long Brooker Belcourt used to spend creating a single earnings preview when he worked at hedge funds. Pulling data from multiple sources. Formatting tables in Excel. Writing up the beat/miss history. Building guidance comparisons. Assembling it all into a Word document or PowerPoint that would be outdated by tomorrow.

“My dashboard would be like a Word document or a PowerPoint presentation. It wouldn’t be interactive. It wouldn’t be live.”

Now he does the same work in 20 minutes. And the output is an interactive Streamlit dashboard he can manipulate, filter, and explore.

The Compute Gap

Brooker spent a decade at hedge funds before moving to fintech startups. Most recently, he ran the finance vertical at Perplexity. He understands both sides—what financial analysts need, and what AI tools can actually deliver.

The gap frustrated him.

“When you use ChatGPT or the web-based interfaces, you’re pretty much only getting 20 to 30 minutes of compute.”

Web interfaces impose limits. Time limits. Context limits. Character limits. They’re designed for quick queries, not deep research.

“Ever since the start of 2025, we’ve expanded to offer LLMs significantly more time to process and create answers. But the web apps have kind of stuck at 20 minutes.”

Claude Code doesn’t have that ceiling. It runs locally, connects to external data sources, and executes for as long as the analysis requires.

“That’s why Claude Code is getting so much attention right now. This gap is so massive.”

The Claude Code Setup

Brooker’s system combines three elements: Claude Code, MCPs, and version-controlled prompts in GitHub.

MCPs—Model Context Protocol servers—give Claude direct access to external data. Daloopa provides institutional-grade financials. Transcripts. SEC filings. The stuff that used to require expensive terminal subscriptions.

“I just said, ‘Use the Daloopa MCP.’ I’m not writing any code or anything about that.”

The prompts themselves live in a GitHub repo as Claude Code skills. Each skill encodes Brooker’s investment philosophy: what metrics matter, which data sources to prioritize, how to structure the output.

“I give it my investing principles. Like, I like all the key metrics. I like trajectory. I like accelerating businesses, not decelerating businesses.”

This matters because LLMs are “very consensus in the way they look at ideas.” Without guidance, they produce generic analysis. The skills inject expertise.

Building a Dashboard

Here’s how it works in practice.

Brooker wants an earnings preview for Meta. He calls a slash command that references his pre-built skill. Types one sentence: “Build an earnings preview for Meta.”

Claude Code starts working. It pulls data from the Daloopa MCP. Accesses transcripts stored on his computer. Runs calculations. Generates visualizations.

Twenty minutes later: an interactive Streamlit dashboard running on localhost.

“It can have tabs. This is crazy robust.”

The dashboard includes:

- Beat/miss track record for 12 quarters

- Four-quarter trend analysis

- Revenue guidance versus actual results

- A mini model in Excel format

- All sourced directly from financial data APIs

“I can scroll over here and get more detail. And this is all coming from an MCP. So it’s actually really good financial data.”

Natural Language Control

The details matter.

When Brooker said “I want a guidance analysis,” he didn’t specify chart types or layouts. Claude chose appropriate visualizations automatically.

“I just say what I want. Should this be a bar chart? Should this be a line chart? How should I present this? I don’t have to talk about that.”

The dashboard adapts to each company. Meta guides revenue, expenses, CapEx, and tax rate. Another company might only guide EPS. The system flexes.

“It’s flexible enough so that you can have a unique dashboard for every single company or project that you’re working on.”

This is different from template-based tools. The output is genuinely custom, shaped by Claude’s understanding of what the user requested and what the data supports.

Why GitHub Matters

The prompts live in GitHub. This solves a problem every heavy ChatGPT user knows.

“When you start to use ChatGPT and you’re starting to produce these prompts, they get to be really, really long and they start to hit this 8,000 character limit.”

More importantly: good prompts are intellectual property. They encode expertise. They should be versioned, iterated, refined.

“I think it’s really important to start building this IP of these prompts. I think they’re so valuable and GitHub is a great place to store that.”

Brooker’s GitHub repo contains skills for different research types. Earnings previews. Company analysis. Transcript summaries. Each one version-controlled, each one improving over time.

The Meta-Transformation

What Brooker built isn’t just faster research. It’s a different category of output.

“It’s like you’re building a Bloomberg or a dashboard system like a Koyfin for your entire process.”

Traditional research produces static documents. Claude Code produces interactive applications. The analyst becomes an infrastructure builder.

“The software development is combined with the query and the actual output.”

Brooker still isn’t a programmer in the traditional sense. He doesn’t write Python. He doesn’t debug code. He describes what he wants and iterates on the result.

But he has something programmers traditionally built: custom financial research infrastructure that runs on his terms.

The Bigger Picture

Brooker now consults with investment firms, helping them understand this new landscape.

“I actually publish all my trades and all my ideas and all my research on X. And so you can actually see all my trades. It’s totally transparent.”

He’s particularly excited about where this is heading.

“I’m really excited about this line going up” — referring to the expanding compute available to LLMs.

For financial analysts, the implication is clear: the tools that used to require Bloomberg terminals and armies of junior analysts are becoming accessible to anyone willing to learn this new interface.

“You can create so much more analysis and let it run for so much longer on your machine.”

Getting Started

For those interested in replicating this approach:

Data sources:

- Institutional: Daloopa, FactSet, Bloomberg (if you have access)

- Retail: Perplexity Finance (free transcripts and financials)

- API access: Fiscal AI for programmatic data

Infrastructure:

- Claude Code for orchestration and code generation

- MCPs for data connections

- GitHub for prompt version control

- Streamlit for interactive dashboards

Mindset shift: The goal isn’t to learn Python. It’s to describe your investment process precisely enough that Claude can implement it.

“LLMs are just very consensus in the way they look at ideas. So I’m turning Claude into this research agent that is running code to produce these custom dashboards.”

Your edge isn’t coding skill. It’s domain expertise, articulated clearly.